sales tax on leased cars in virginia

Or can I have the sales tax distributed over the monthly lease payments so Id be paying 124 or 136 of the sales tax each. For vehicles that are being rented or leased see see taxation of leases and rentals.

Virginia Vehicle Sales Tax Fees Calculator

Sales leases and rentals of motor vehicles are not subject to the retail sales and use tax provided they are subject to the Virginia motor vehicle sales and use tax administered by the Department of Motor Vehicles and further provided that such tax has been paid.

. Vehicles leased to a person versus a business and used predominantly for non-business purposes may qualify for car tax relief. The Virginia Department of Motor Vehicles states that there is a 4 percent sales tax rate for any vehicle that you purchase within state lines with the minimum sales tax for purchased vehicles. For the purposes of the Motor Vehicle Sales and Use Tax collection gross sales price includes the dealer processing fee.

Effective July 1 2016 unless exempted under Va. Browse Questions from Car Experts. Then multiply the car price by the rate to see what youd pay in taxes.

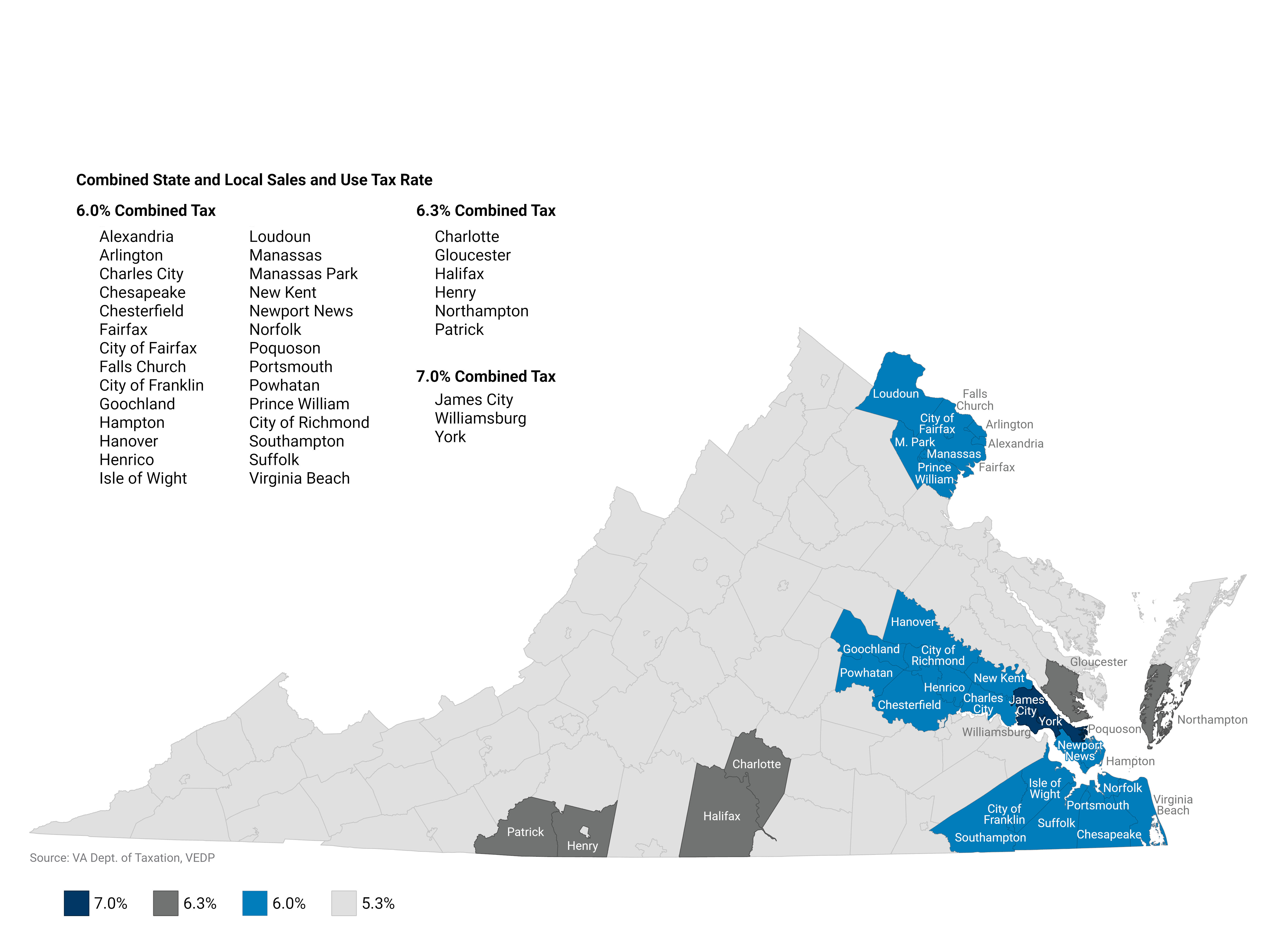

Ad Find Car Sales Tax In Virginia. Several areas have an additional regional or local tax as outlined below. Sales tax is a part of buying and leasing cars in states that charge it.

Vehicles leased to a person versus a business and used predominantly for non-business purposes may qualify for car tax relief. What Is The Sales Tax On A Leased Vehicle In Virginia. In Fairfax county of instance its 6.

Some leased vehicles may qualify for Personal Property Tax Relief as provided in 581-3523 etseq. Id like to lease car but Ive heard different things about how you pay the sales tax when leasing a car for registration in Virginia. Lease a new Toyota GR86 in Virginia for as little as 440 per month with 1000 down.

Virginia VA Sales Tax and Lease Purchase Option. Grocery items and cer tain essential personal hygiene items are taxed at. Check the sections youd like to appear in the report then use the Create Report button at the bottom of the page to generate your report.

Titling registration etc for your leased vehicle. Some leased vehicles may qualify for Personal Property Tax Relief as provided in 581-3523 etseq. In some parts of Virginia you may pay up to 7 in car sales tax with local taxes.

Sales tax in Virginia is levied on the ENTIRE value of the car not just the depreciation as is done in most other states. For most passenger vehicles the motor vehicle rental tax equals 10 of the amount that you pay for the rental. Sales tax is a part of buying and leasing cars in states that charge it.

For example if you purchase a new vehicle for 50000 then you would multiply that purchase price by. What is the sales tax on cars purchased in virginia. Once the report is.

0415 and get a sales tax amount of 2075. For vehicles that are being rented or leased see see taxation of leases and rentals. Dodge Charger Scat Pack Lease.

All applicable fees are due at the time of titling by the lessor such as the 15 title fee and the motor vehicle sales and use tax. Virginia collects a 400 state sales tax rate on the purchase of all vehicles with a minimum tax of 75 dollars. Virginia Motor Vehicle Sales and Use Tax 581-2400.

The tax is broken down into three parts. Table of Contents Title 23. The sale tax on cars purchased in Virginia is 415.

The car sales tax in Virginia starts at 415 with a minimum of 75 at the state level but taxes at the county and local levels can add up to 27. Retail Sales and Use Tax 23VAC10-210-840. Find your perfect car with Edmunds expert reviews car comparisons and pricing tools.

Taxation Agency 10. The tax applies to vehicles rented for less than 12 months regardless of what type of dealer you rent it from. A tax on the rental of motor vehicles in Virginia.

Find out how taxes on vehicle rentals and leases are calculatedThe state collects four percent of the revenue collected in VirginiaTaxpayers have a zero state sales tax rate on purchases of all vehiclesCars purchased in Virginia may also have to pay registrations titles and plate fees in addition to taxes. However 415 is the statewide sales tax. Generally that should be disscussed with the dealer.

Heres an explanation for. Sales tax on leased cars in virginia. Would I have to pay the full 415 sales tax for the car upfront due at signing.

The average combined tax rate on a car sale in Virginia is 5624. Effective July 1 2016 unless exempted under Va. The rate is 415 but can be higher with the addition of local taxes.

To determine the sales tax on a car add the local tax rate to the statewide 415. Code 581-2402 Virginia levies a 415 Motor Vehicle Sales and Use SUT Tax based on the vehicles gross sales price or 75 whichever is greater. How to Calculate Virginia Sales Tax on a Car.

The sales tax rate for most locations in Virginia is 53. In addition to taxes car purchases in Virginia may be subject to other fees like registration title and plate fees. The rate is 415 but can be higher with the addition of local taxes.

In all of Virginia food for home consumption eg. Like with any purchase the rules on when and. Department of Taxation Chapter 210.

Virginia Sales Tax On Cars Everything You Need To Know

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Which U S States Charge Property Taxes For Cars Mansion Global

Income Tax Prep Checklist Free Printable Checklist Tax Prep Checklist Tax Prep Business Tax Deductions

Virginia Separation Agreement Template Best Of 50 Simple Llc Separation Agreement Lu L Separation Agreement Template Separation Agreement Contract Template

/images/2022/02/08/woman_in_car.jpg)

How To Legally Avoid Paying Sales Tax On A Used Car Financebuzz

Check Me Out On Cnn Com Test Day Breathalyzer Its All Good

A Complete Guide On Car Sales Tax By State Shift

Nj Car Sales Tax Everything You Need To Know

Commercial And Industrial Sales Use Tax Exemption Virginia Economic Development Partnership

Virginia Vehicle Sales Tax Fees Calculator

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Filing Your Tax Return Don T Forget These Credits Deductions National Globalnews Ca Small Business Tax Business Tax Bookkeeping Business

Virginia Vehicle Sales Tax Fees Calculator

Arizona Sales Tax Small Business Guide Truic

What S The Car Sales Tax In Each State Find The Best Car Price

Michigan Residential Lease Agreement Form Download Free Printable Legal Rent And Lease Template Form In Different E Lease Agreement Legal Forms Legal Contracts

Do I Have To Pay A Car Tax On A New Or Used Car Credit Karma