capital gains tax proposal effective date

Asset included in the total assets of a company that is a foreign. Add sub node for termination EE under node income tax.

12 Wedding Budget Templates Word Excel Pdf Templates Wedding Budget Template Wedding Budget Spreadsheet Budget Wedding

Our breaking political news keeps you covered on the latest in US politics including Congress state governors and the White House.

. Future changes to the corporate tax system such as the measures implemented by various. Last working date ID type and ID number for SIPHFTax report etc. We estimate the new House bill would reduce long-run GDP by about 05 percent and long-run American incomes as measured by gross national product or.

The Taxpayer Relief Act of 1997 reduced capital gains tax rates to 10 and 20 and created the exclusion for ones primary. Before 2018 the tax brackets for. Since 1937 our principled research insightful analysis and engaged experts have informed smarter tax policy at the federal state and global levels.

Asset entity has the meaning given by section 12-436 in Schedule 1 to the Taxation Administration Act 1953. The capital gains tax rates typically apply to nearly all capital gains income whereas the estate tax applies only to the part of an estate that exceeds the exemption level. This argument is flawed.

Asset-based income tax regime has the meaning given by section 830- 105. Capital gains tax rates were significantly. The estate taxs average effective rate of 17 percent in 2017 is below the capital gains rate 6.

To improve lives through tax policies that lead to greater economic growth and opportunity. For over 80 years our goal has remained the same. The planned release with 2 phases will include the enhancement for.

Moneycontrol PF Team February 04. The effective tax rate is the rate of taxation implied by the actual quantum of tax paid versus profits before all deductions are applied. Chartered accountants decode the crypto tax on matters including the date on which the tax becomes effective the cost of acquisition and who will deduct TDS.

The Tax Foundation is the nations leading independent tax policy nonprofit. While the latest proposal steers clear of some of the major tax rate increases of the original Ways and Means bill this proposal would still raise taxes on work and investment disincentivizing productive activity. This period saw the creation of Corporation Tax which combined the Capital Gains Income and Corporation Profits Tax that firms previously had to pay.

After the passage of the Tax Cuts and Jobs Act TCJA the tax treatment of long-term capital gains changed. The 1990 and 1993 budget acts increased ordinary tax rates but re-established a lower rate of 28 for long-term gains though effective tax rates sometimes exceeded 28 because of other tax provisions. Income tax expense related to.

Assessment day for an income year of a life insurance company has the meaning given by section 219- 45. Termination EE and Last Working Date in tax report for GTSⅢ May 2018 According to the requirement from GTSⅢ further information needs to be included when declaration. Capital gains incentive fees attributable to net realized and unrealized gains and losses 006 036 013.

The Estate Tax Is a Significant Revenue Source.

No More Extension Of Last Date For Filing Audit Reports Income Tax Returns In 2021 Income Tax Return Income Tax Tax Return

Tax Proposals Under The Build Back Better Act Version 2 0

Free Invoice Templates For Word Excel Open Office With Regard To Business Invoice Temp Invoice Template Word Invoice Template Microsoft Word Invoice Template

Profit And Loss Statement For Service Business Template Profit And Loss Statement Learn Accounting Income Statement

House Democrats Propose Hiking Capital Gains Tax To 28 8

Sample Personal Financial Statement Template Personal Financial Statement Financial Statement Statement Template

Best Balanced Mutual Fund Schemes Equity Oriented Review Mutuals Funds Investing Money Fund

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Printable Sample Loan Document Form Legal Forms Free Basic Templates Document Templates

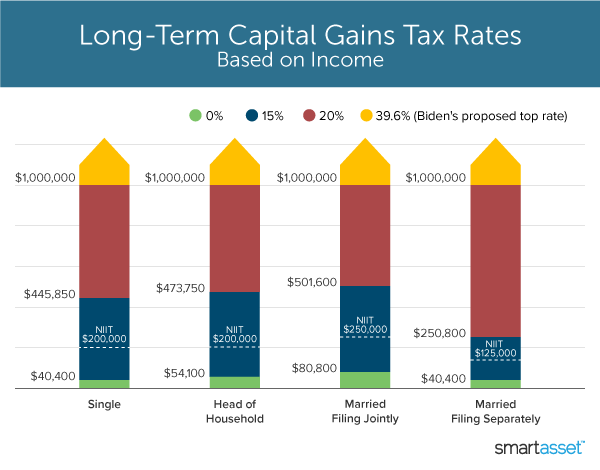

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels

What S In Biden S Capital Gains Tax Plan Smartasset

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

Residential Rental Lease Agreement Pet Addendum Agreement Rental Agreement Templates Lease Agreement Being A Landlord

House Democrats Propose Hiking Capital Gains Tax To 28 8

Free Templates For Office Online Office Com Business Proposal Letter Business Plan Proposal Proposal Templates

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

House Rent Receipt Template Receipt Template Word Template Templates

President Biden S Stepped Up Basis Tax Proposal Forbes Advisor

Biden Budget Reiterates 43 4 Top Capital Gains Tax Rate For Millionaires